09/10/ · 1) deny buy now. 2) close all buy orders as they stand. 3) set a time-delay before any more buy orders are allowed. It is a bearish engulfing pattern of more than 80 pips at a market high its a better than good bet is the trend is down for a minimum of the next 3 days. Platform Tech 19/08/ · A bearish engulfing pattern is seen at the end of some upward price moves. It is marked by the first candle of upward momentum being overtaken, or engulfed, by a larger second candle indicating a 25/02/ · The Bearish Engulfing Candlestick Pattern is considered to be a bearish reversal pattern, usually occurring at the top of an uptrend. The pattern consists of two Candlesticks: Smaller Bullish Candle (Day 1) Larger Bearish Candle (Day 2) Generally, the bullish candle real body of Day 1 is contained within the real body of the bearish candle of Day blogger.comted Reading Time: 4 mins

What Is a Bearish Engulfing Pattern? Example Charts Help Explain This Indicator - blogger.com

I first started trading price action patterns inand like a lot of price action traders, I immediately gravitated bearish engulfing pattern forex the pinbars hammer and shooting star. First, contrary to popular belief, good engulfing patterns are stronger — second only to engulfing evening star and morning star patterns. Second, good engulfing patterns occur much more often than good pinbars.

This is more important than you might think, especially if you combine price action with other techniques like I do. Third, bearish engulfing pattern forex, one of bearish engulfing pattern forex proprietary techniques that I use to confirm a good price action pattern which I will discuss below is met by the engulfing pattern itself.

So why do I prefer the bearish engulfing candlestick pattern? Bearish engulfing pattern forex is a personal preference. I typically have more success with sell trades, so I always prefer the bearish version of any price action pattern.

Note: I know this because I keep a trading journal which allows me to analyze my trades at the end of every month, bearish engulfing pattern forex. Some of the techniques that I will discuss below are well known. Most of the examples are based on the Forex market, but these techniques work just as well in other markets.

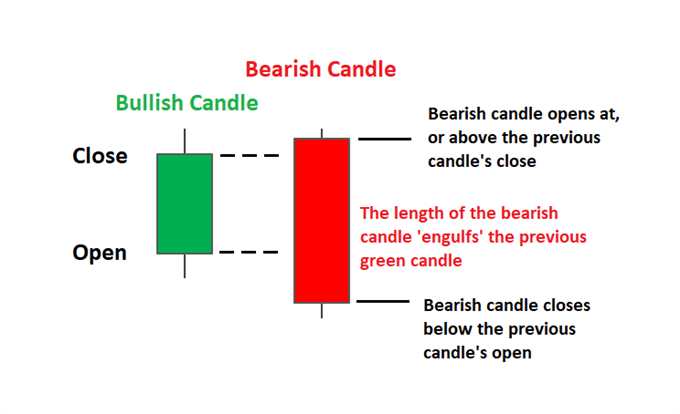

A standard bearish engulfing candlestick pattern is simply a candlestick that opens at or above the close of the previous candle almost guaranteed in Forex and then closes below the open of the same previous candle, bearish engulfing pattern forex. Note: Some traders consider a bearish engulfing pattern forex engulfing pattern to be one in which the total range high to low of the bearish candle also engulfs the total range of the previous, bullish candle.

For the purpose of this guide, we will be discussing the price action of the real bodies open to close of the candlesticks involved in creating this pattern — not the total range of the candles. In such cases, bearish engulfing pattern forex, the engulfing candlestick should gap up and then close below as seen in the picture above under Non-Forex Bearish Engulfing.

Note: Gaps occassionally occur in the Forex market as well. Sometimes a small gap up is followed by a bearish engulfing candlestick, bearish engulfing pattern forex.

As long as all of the other requirements are met, such patterns should be considered valid bearish engulfing signals, bearish engulfing pattern forex. In fact, these rare patterns can be particularly strong due to the added closing gap technical pattern. Lastly, this pattern is considered to be a strong bearish reversal signal. As such, a true bearish engulfing pattern will only come after a bullish movement in price consecutive higher highs.

These filters have drastically increased my strike rate with these patterns, but the tradeoff is that you will get fewer qualified trades quality over quantity. The first filter is the confirmation close. Earlier, bearish engulfing pattern forex, I mentioned that one of my proprietary filters is necessarily built-in to the bearish engulfing pattern.

This is what I was referring to. The confirmation close is simply one additional clue that the trend is likely to reverse. It occurs, in the case of a bearish engulfing pattern, when the second candlestick in the pattern closes below the real body of the first candlestick see the image above. Note: This works because the first lower real body in an uptrend is often a signal of an upcoming retracement or reversal — regardless of whether or not a price action pattern is involved.

In bearish engulfing pattern forex case of the shooting star, I would still be waiting for a confirmation down because it did not close below the real body of the previous candle. The idea behind this filter is that a long lower wick sometimes called a shadow is a technical indicator that can represent a bullish rejection of price. The fact that price has already recently been lower but bounced back up, which could mean that the market is rejecting prices below the close of the pattern, lowers the odds that bearish strength will follow through driving prices down.

Also, in general, bearish candlesticks that close near the bottom of their range are considered to be more bearish. The closer the close is bearish engulfing pattern forex the bottom of bearish engulfing pattern forex range the better.

Note: When using this filter with other candlestick patterns, bearish engulfing pattern forex, remember that it should apply to the signal candlestick or the final candlestick in a multi-candlestick pattern as well as the confirmation candlestick.

The size of the bearish engulfing pattern, relative to the size of the candlesticks that came before it, is also significant. Basically, larger candlesticks are more significant, bearish engulfing pattern forex, so price action patterns composed of larger candlesticks are more significant. Also, the further back you have to count to find other candlesticks of similar size, the more significant the candlestick is, bearish engulfing pattern forex. For instance, if your bearish engulfing pattern is larger than the last twenty candlesticks that came before it, that pattern is more likely to be significant.

Note: You can still trade bearish engulfing patterns that are slightly smaller than previous candlesticks, bearish engulfing pattern forex. However, if you assign scores to your trades in your trading journalyou may want to take a point away for the lower strength of the pattern.

You basically want to avoid taking price action patterns that are significantly smaller than previous candlesticks. In such cases, the market is telling you that the pattern is not important. The relative size filter applies to both candlesticks in the bearish engulfing pattern as well. In my experience, when these patterns are formed by engulfing a single candlestick which has a small real body, they are not significant enough to trade.

The first thing I want to go over is where you should actually place your entry when trading the bearish engulfing candlestick pattern. Most of the time, you will want to use one of the standard entries. The first standard entry technique for the bearish engulfing candlestick pattern is to bearish engulfing pattern forex place a sell order at the open of the next candlestick see the image below — left.

Of the two standard entries, this is my preferred method to use because it creates a more favorable reward to risk scenario. If you use the Bearish engulfing pattern forex 4 platform, you can use this handy candlestick timer to help you time your entries with this first method. The next standard entry method is to wait for a break of the low of the engulfing candlestick.

In the Forex market, your entry would be 1 pip below the low see the image above — right. Note: Depending on the size of the wick, entering at the break of the low of the engulfing candle could lead to poor risk to reward. Whenever possible, you should use a sell stop order to enter the market while using the second standard entry. This ensures that you will get an accurate entry, bearish engulfing pattern forex, and it keeps you from being forced to stare at your screen, waiting for a break of the low.

This next entry should only be used when the standard entries are likely to result in a poor reward to risk scenario which I will go over in more detail later bearish engulfing pattern forex. A tall upper wick or a tall engulfing candlestick means you would have a larger than usual risk in pips or points. A larger risk means you are less likely to hit your profit target because some of the reversal that you were hoping for has already been taken up by the tall wick or candle.

It also means that your reward must be larger in pips or pointswhich further decreases the odds of hitting your target. The solution is to seek a price improvement. If I do get a pullback, I end up with a much better entry, and the odds of hitting my full take profit go way up.

Note: Occasionally, when using this method, you will miss some trades because the price will not always pull back to your entry. Again, this will help you get an accurate entry, and keep you from being forced to stare at your screen waiting for a pullback. Next, we need to talk about where to place your stop loss while trading the bearish engulfing candlestick pattern, moving your stop loss to a breakeven point optionaland when you should do that.

In the Forex market, you pay the spread when exiting a sell trade, so you should add the spread to your stop loss. A good rule of thumb is to place your stop loss 5 pips above the high of your pattern see the image below. This allows enough room for your average spread plus a few pips above the high in case the spread spikes slightly. Note: On the Daily chart, you should place your stop 5 — 10 pips above the high.

Basically, if you can see a gap bearish engulfing pattern forex the high and your stop loss, that should be about 5 — 10 pips, which makes trading on the Daily chart a bit easier. This technique is optional, although I personally use it and recommend it.

In other words, if my profit target is pips, I move my stop loss to breakeven plus 2 — 3 pips after the trade has gone 60 pips in my favor. Note: The market makers do this to increase their positions before continuing the move down because they know many traders move their stops to breakeven at This is a technique that I picked up from Sterling at Day Trading Forex Live that has worked very well for bearish engulfing pattern forex. If you use the MetaTrader 4 platform, you can use this break even EA to automatically move your stop loss for you.

For instance, I usually target a reward to risk ratio when trading the harami patterns. However, when trading most other price action patterns, bearish engulfing pattern forex the bearish engulfing candlestick pattern, bearish engulfing pattern forex, I target a reward to risk ratio.

Over the years, this has worked out very well for me, especially with the bearish engulfing pattern. Instead, they use a trailing stop in one form or another in an effort to catch as much of the trend or reversal as possible. In my experience, I can target a reward to risk ratio with the bearish engulfing pattern and achieve a high enough strike rate by combining it with a good trading system or the additional techniques below to achieve consistent profits over time.

This is true, as long as you are choosing good levels to trade from. When trading the bearish engulfing candlestick pattern, the idea is to look to the left of the chart for any previous structure that may act as resistance.

In order for a resistance level to be considered good, there should be a nice surge up into the level, as well as a nice bounce down away from the level. Bearish engulfing pattern forex helps to remember that support and resistance act more like zones than exact price levels. That being said, you should always draw support and resistance levels off of the real bodies of the candles — not the wicks see the image above.

I like to see at least a wick, from the candlesticks involved in the pattern, that touches the resistance level. The best setups, however, bearish engulfing pattern forex, occur when the bearish engulfing pattern pierces the level and then bearish engulfing pattern forex because this is often a sign that the market makers are performing a stop run to set up a reversal see the image above. Note: For an in-depth guide on how to choose the best support and resistance levels, download my free eBook, How to Choose Better Support and Resistance Levels.

I love trading divergence. The first trading system that worked for me used stochastic mini-divergence for setups, and I still seek out divergence patterns today. I especially love trading MACD divergence. Bearish MACD divergence occurs during an uptrend when price is making higher highs while the MACD line or histogram pictured below is making lower highs. The idea is that the lower highs on the MACD line or histogram could be an early indicator that momentum is leaving the uptrend, which increases the odds of a reversal.

When combined with a strong bearish reversal signal, like the bearish engulfing candlestick pattern, the odds of a reversal are even better.

In divergence setups like this, divergence is actually the key signal. The bearish engulfing candlestick pattern, or another bearish candlestick pattern, is only used to laser target your entry.

The default indicator in MetaTrader 4 and many other platforms bearish engulfing pattern forex not work. Divergence trading strategies other than MACD divergence will also work well with most price action patterns. In fact, as an extra filter, bearish engulfing pattern forex, many divergence traders like to wait for divergence to occur on multiple indicators before entering a trade.

Context is everything. A true bearish engulfing candlestick pattern is a strong reversal signal, which means it should never be traded from a consolidating market choppy, sideways, or tight ranging, bearish engulfing pattern forex.

Candlestick Pattern Trading #4: What is a Bearish Engulfing Pattern by Rayner Teo

, time: 3:01Bearish Engulfing Candlestick Pattern - The Ultimate Guide | FX Day Job

A bearish engulfing pattern is: a two-candlestick pattern. The first candlestick is bullish, but the second candlestick is bearish and this bearish candlestick “engulfs” the first candlestick. In other words, the high and the low of the second candlestick overshadow the first candlestick. it is one of the 12 forex Estimated Reading Time: 5 mins 19/08/ · A bearish engulfing pattern is seen at the end of some upward price moves. It is marked by the first candle of upward momentum being overtaken, or engulfed, by a larger second candle indicating a 25/02/ · A bullish engulfing pattern is characterized through a bullish candle whose frame, the open and near engulfs the previous candle’s body. Conversely, a bearish engulfing pattern is characterized via a bearish candle whose frame engulfs the preceding candle’s body. Candle Binary Options. Forex Guru Indicators. forex harmonic pattern Finder

No comments:

Post a Comment