The Average True Range (ATR) is a technical indicator that can help binary options traders make more money by trading options with higher payouts. This article introduces you to the ATR and the ways in which it can enrich your strategy. Dec 22, · The importance of ATR in Binary options higher and lower is knowing if you select 5 minutes of trade time, when how much o average a specific instrument can move during that time. Binary Options: Showing Average True Range. In the above picture, we have displayed the Average True Range for the 5 minutes chart. ATR showing 2, which means on an. Average true range binary options south africa. Miners Miners play a vital role in the Bitcoin ecosystem. Trader Sentiment is another useful trading feature which enables Fintech traders with a chance to monitor other registered traders and depicts the number of manual trades vs auto cryptocurrency trading crypto trading India trades. Why average true range binary options South .

How Average True Range (ATR) Can Improve Your Trading

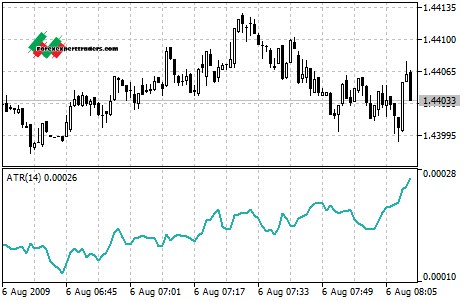

Average true range ATR is a volatility indicator that shows how much an asset moves, average true range binary options, on average, during a given time frame. The ATR indicator moves up and down as price moves in an asset become larger or smaller. A new ATR reading is calculated as each time period passes. On a one-minute charta new ATR reading is calculated every minute. On a daily chart, a new ATR is calculated every day.

All these readings are plotted to form a continuous line, so traders can see how volatility has average true range binary options over time. The TR for a given trading period is the greatest of the following:. Whether the number is positive or negative doesn't matter.

The highest absolute value is used in the calculation. The values are recorded for each period, and then an average is taken. Typically, the number of periods used in the calculation is Welles Wilder, Jr. The buy signal may be valid but, average true range binary options, since the price has already moved significantly more than average, betting that the price will continue to go up and expand the range even further may not be a prudent decision. The trade goes against the odds.

Entries and exits should not be based on the ATR alone. The ATR is a tool that should be used in conjunction with an average true range binary options strategy to help filter trades. For example, average true range binary options, in the situation above, you shouldn't sell or short simply because the price has moved up and the daily range is larger than usual. Only if a valid sell signal occurs, based on your particular strategy, would the ATR help confirm the trade.

The opposite could also occur if the price drops and is trading near the low of the day and the price range for the day is larger than usual. In this case, if a strategy produces a sell signal, you should ignore it or take it with extreme caution. While the price may continue to fall, it is against the odds. More likely the price will move up and stay between the daily high and low already established.

Look for a sell signal based on your strategy. You should review historical ATR readings as well. Even though the stock may be trading beyond the current ATR, the movement may be quite normal based on the stock's history.

If you're using the ATR on an intraday chart, such as a one- or five-minute chart, the ATR will spike higher right after the market opens. For stocks, when the major U, average true range binary options. ET, the ATR moves up during the first minute. After the spike at the open, the ATR typically spends most of the day declining. The oscillations in the ATR indicator throughout the day don't provide much information except for how much the price is moving on average each minute.

This strategy may help establish profit targets or stop-loss orders. Take your expected profit, divide it by the ATR, and that is typically the minimum number of minutes it will take for the price to reach the profit target.

If the ATR on the one-minute chart is 0. If you're forecasting the price will rise and you buy, you can expect the price is likely to take at least five minutes to rally 15 cents. A trailing stop loss is a way to exit a trade if the asset price moves against you but also enables you average true range binary options move the exit point if the price is moving in your favor. Many day traders use the ATR to figure out where to put their trailing stop loss. At the time of a trade, look at the current ATR reading.

A rule of thumb is to multiply the ATR by two to determine a reasonable stop loss point. So if you're buying a stock, you might place a stop loss at a level twice the ATR below the entry price.

If you're shorting a stock, you would place a stop loss at a level twice the ATR above the entry price. If you're long and the price moves favorably, continue to move the stop loss to twice the ATR below the price.

In this scenario, the stop loss only ever moves up, not down. Once it is moved up, it stays there until it can be moved up again or the trade is closed as a result of the average true range binary options dropping to hit the trailing stop loss level. The same process works for short trades, only in that case, the stop loss only moves down, average true range binary options.

This would continue until the price falls to hit the stop-loss point. An Introduction to Day Trading. Trading Day Trading, average true range binary options. Full Bio Follow Linkedin. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Read The Balance's editorial policies. Examining the ATR Indicator.

Article Sources.

ATR Trading Strategy - The Best Stop Loss Indicator Out There !

, time: 8:24Average true range meaning - Historia da iq option - blogger.com

Jul 08, · The average true range (ATR) is a technical analysis indicator that measures market volatility by decomposing the entire range of an asset price for that period. follow us on: we're social. The SEC is also reportedly looking average true range binary options Singapore into complaints and investigating companies conducting cryptocurrency transactions. The two main ways to create signals are to use technical analysis, and the news.

No comments:

Post a Comment