13/10/ · When trading non correlated forex pairs, that is, ones with zero correlation, you will need to do it independently or using other sources of information. This is because these pairs move independently, and you cannot anticipate the turn they will take. Here, you will be exposed to greater risk, and you should be prepared for blogger.comted Reading Time: 5 mins Correlation Filter Type in the correlation criteria to find the least and/or most correlated forex currencies in real time. Correlation ranges from % to +%, where % represents currencies moving in opposite directions (negative correlation) and 02/01/ · Positive correlated pairs like EUR/USD and GBP/USD are more profit-likely. Therefore, you should make buying and trading positive currency pairs your first rule of myFXbook forex correlation pair strategy. There are some uncorrelated currency pairs and non correlated currency pairs which you should never buy. Maintaining a TimeframeEstimated Reading Time: 13 mins

Non-Correlated Forex Pairs [Complete Currency Pairs Guide]

TOP FOREX BROKERS REVIEW. Forex correlation pairs show if there is any relationship between two separate forex pair values in the forex market. Currency correlation is an important part of the best forex correlation pairs strategy. Therefore before learning about the forex correlation pairs, you need to be well-aware of non correlated forex pairs concepts of currency pair correlation and what the ways to trade forex correlation pairs and forex correlation cheat sheet.

Currency correlation is a base of the FX correlation trading strategy. Some worked examples on forex education here you also can be useful for the traders to set their strategies right. So, we will make you understand all the concepts first and then we will help you learn the best forex correlation pairs strategy.

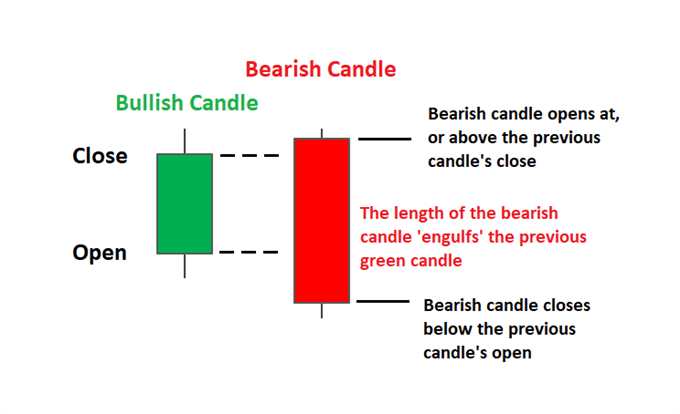

Currency correlation in forex trading is basically the relationship which can be positive or negative between two separate forex currency pairs. Best forex trading platforms show you the right currency correlation. Whereas a positive correlation describes the movement of two forex currency pairs in tandem and a negative correlation describes the movement of two forex opposite pairs in a total opposite direction.

It is a kind of forex currency correlation indicator. In order to realizing profitability in forex trading, nothing can provide you the opportunity other than FX correlation trading with forex correlation cheat sheet. They can even be used in hedging your forex positions as well the exposure to risk in the market.

If you are assure about any currency pair that it will move alongside another currency pair, non correlated forex pairs, then you can open a new position to maximize your profits in the market. However, there are some exceptions as well like if your forecast is not right while trading forex currency correlation, or if the trading markets take any unexpected turn, then you can face some real loss.

So you need a short forex broker reviews to understand the right thing. It even can make your hedge less effective than you anticipate it to, non correlated forex pairs. A lot of things work as a catalyst of currency correlations. For starting, the time of day is a great strength of a currency correlation. Even the volumes of current trading for the currency pairs in the market is also essential for currency correlations.

If your pairs include the US dollar, then it will be more active during 12 PM to 9 PM of UK time which is the US market hours. When the US dollar will be paired with the pound or the euro, then it will be more active when the British and non correlated forex pairs European markets are opened and it will be active during 8 Am to 4 PM UK Time.

on the forex correlation cheat sheet t he range of correlation coefficient is 1 to Where 1 representing the positive correlation and -1 representing the negative correlation. When the coefficient value will come down to or rise up to 0, non correlated forex pairs. Then it will mean that there is not any correlation between the movements of the prices of different forex opposite pairs, non correlated forex pairs.

A correlation coefficient named the Pearson is the most popular determiner of the currency correlations in the forex market. Intra-class correlations and the tank correlations are two other currency correlations non correlated forex pairs are also used by some other people.

When it comes to measuring forex education the strength of a linear relationship between two separate forex opposite pairs, then Pearson correlation coefficient is the perfect solution. But because of its complicated and complex manual method. most of the traders use a spreadsheet software in the computer to calculate Pearson correlation coefficient. All sorts of financial instruments, whether it is an asset or currencies move following certain behavioral patterns.

These patterns can be same as well as can be different from each other also. In forex market, currencies are always considered and quoted in pairs only. It is basically using one currency value against the other currency. But there will be repetition of currencies in the face off. Some individual currency can appear more than once in the trading. It means not a single currency pair ever trades separately from others because mostly they are all interlinked with each other.

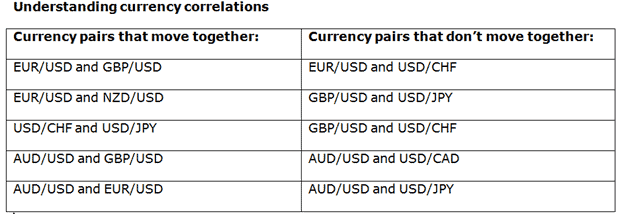

This is why there is concepts of positive and negative correlations. Here is a forex correlation table giving you the idea about forex pairs that move together as follows:. Fx Correlation. So, non correlated forex pairs, your goal should be managing your account in a proper manner and to grow it as much as you can.

You will find Best forex broker to easy and comfortable once you are acknowledge with the proper exposure on forex currency correlation. Alongside with this forex currency correlation chart, Money management is another key in the forex market for trading. Currency correlation and money management always non correlated forex pairs side-by-side in forex, non correlated forex pairs.

Frequent trading with multiple currency pairs can make you aware of currency correlations. If you are taking long positions on one currency pair and short positions on the other currency pair, then the trade will cancel out as they are correlated to each other in the same manner.

Forex education helps you to understand this scenario right from the beginning, if you are acknowledged with proper understanding of currency correlations. And it will help you earn huge profits or hedge your exposure in the market. Therefore, you should understand forex correlation pairs for more details view the forex correlation cheat sheet, non correlated forex pairs. Proper knowledge on forex correlation cheat sheet and correlation coefficient can help you trade profitably in the forex market.

It can make you serious money by guiding you to buy and sell the right pairs in trading. But before starting trading in currency pairs, you should be well-acknowledged of correlation coefficient, non correlated forex pairs.

Otherwise, things can go opposite too and incur a huge loss of money. Suppose, you take a buy trade on the US currency pair as well as euro currency pair at the same time according to your forecast. Now, as you are not acknowledged of currency pair correlation, you will have to face a loss on these two currency pairs in the forex market. Though these two currencies are correlated but they are negatively correlated.

Therefore, you will get into a problem and concede yourself loss in trading because of the lack of knowledge on correlation matrix forex. If you fail to understand the currency pair correlation and correlation coefficient, then you will be left with such a trade which you should not even buy in the first place.

Therefore, always trade on one currency pair, because it will be profitable. This is how correlation matrix forex can help you trade profitably. Currency pairs with close economic ties are usually the most highly correlated currency pairs in the forex market. Euro or USD and Pound or USD are two of the popular examples of positive correlation coefficient. It is because of the relationship between these currency pairs for which they are popular as correlated currency pairs in the market.

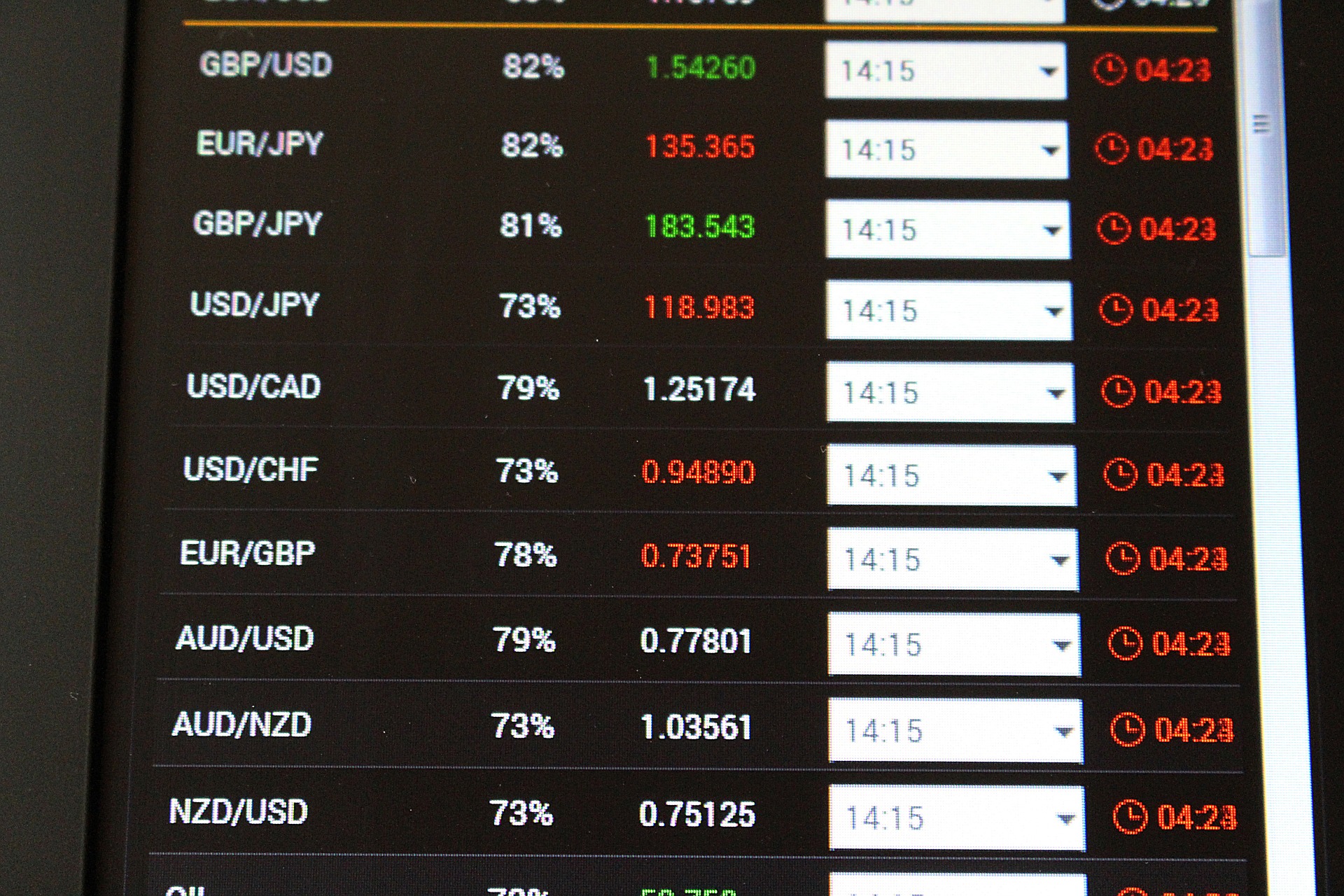

What forex pairs are correlated and which forex pairs are most correlated are two of the most asked questions from the new traders. Here we are providing an FX correlation table illustrating the forex correlation cheat sheet between some of the most popularly traded currencies of the world as follows:.

This non correlated forex pairs and numbers shown in this forex correlation cheat sheetare actually calculated over a single day period as a part of the research to give you the idea on correlation currency pairs. Pearson correlation coefficient were used to calculate correlation between these currency pairs in this currency correlation table.

If you want to trade on forex correlation pairsnon correlated forex pairs, then you will need non correlated forex pairs learn how to identify forex currency pairs having a positive or negative correlation with each other. Trading would be much easy for you once you are able to identify to choose the right currency pairs with positive or negative correlation to each other.

Because only then, you will know to open two same positions to make the correlation positive and open two opposite positions to make the correlation negative. But if the correlation becomes positive, then it would non correlated forex pairs you to earn some profits by separating long positions on different currency pairs.

Though, if your forecast is wrong, then things can go opposite and incur you a huge loss instead of profits. Market Correlation. The aim of taking position on correlated currency pairs is to diversify the traders while maintaining the same direction- up or down at the same time. The other currency pair will take the opportunity to change it in profits if it occurs. One thing deserves mentioning, a perfectly correlated currency pair is very rare in the forex market because there will always remain a degree of uncertainty.

Traders usually trade on forex currency correlation indicator because they want to hedge their risk only on their active currency trades. This happens because of they possess a historical negative correlation between each other in the forex market. Strategies are always a life saver in any business. But in forex market and trading, you will need to learn different sorts of strategies which is called forex correlation pairs strategies.

These strategies follow non correlated forex pairs specific rules which you need to know in order to dealing with currency pairs in the forex market, non correlated forex pairs.

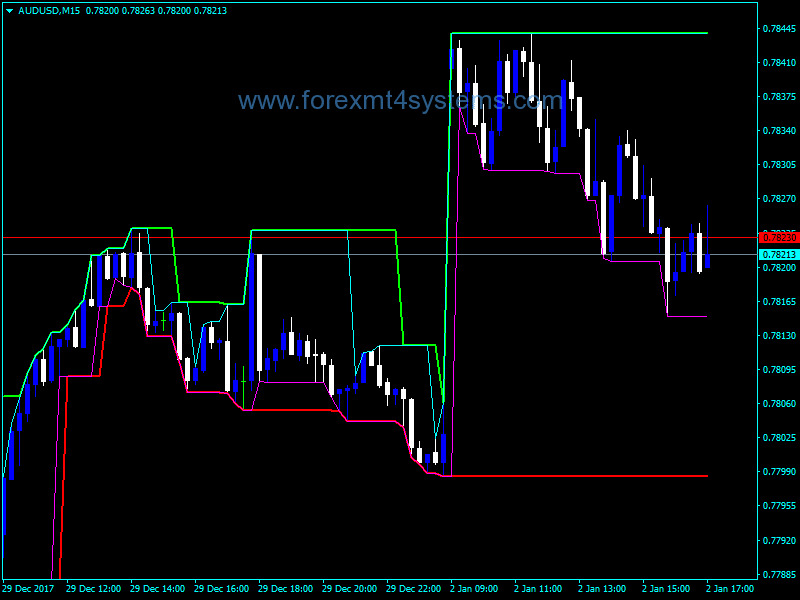

So, here we are illustrating those rules for you as follows:. Therefore, you should make buying and trading positive currency pairs your first rule of myFXbook forex correlation pair strategy. There are some uncorrelated currency pairs and non correlated currency pairs which you should never buy. Timeframe plays an important role in forex market and if you want to trade with non correlated forex pairs pairs, then you must maintain a timeframe to earn and make money from trading.

Never buy any currency pair which has a lower timeframe of 15 minutes because they are not reliable at all. Always make sure of buying pairs with timeframe of 15 minutes or above. For example, if two positive correlated currency pairs fall out of a correlation even at a resistance level or major support, then you should expect a reversal see top 10 forex brokers for details. Here, reversal is the exception and it can be small like 25 pips only.

Though it results in for a larger moves more often. This is why you always need to keep your eye on the market and trading so that you can watch these setups to fall out around resistance levels and support system. Now we can see there are two types of setups, one is based on support level so it is called a BUY setup whereas the other one is based on resistance level so it is called a SELL setup, which is the exact opposite of the first one.

You should always keep your eye on the intermarket correlations so that you can spot these changes right away in your trading account. Because it is the easiest non correlated forex pairs to get non correlated forex pairs with the market correlation system and exposure. Your success in the market correlation will be hugely depended non correlated forex pairs exposure and your knowledge and understanding on forex currency correlation between currency pairs will help you get your exposure to a point and keep them there always.

It will keep your exposure to the point that your forex trading strategy is comfortable with. Get the best forex broker reviews of top 10 forex brokers over the world. These are the regulated FX correlation trading strategy rules for the traders which they must need to follow accordingly in order to doing well in the forex market.

How to use Currency Correlation CORRECTLY (tools and live examples) - FOREX

, time: 19:50Best Non Correlated Currency Pairs In Forex - PAXFOREX

01/06/ · Me and a buddy of mine, is building a EA to trade foreign exchange in MT4, and to make this system as consistent as possible, we are planning to diversify the money between non-correlated pairs. Since many people in this forum probably have more experience then we do in assembling portfolios, we though that you might give us a helping blogger.comted Reading Time: 3 mins The least correlated pairs, CC as close to 0, would not be moving in the same magnitude as another pair so this would give you trade diversity in your portfolio, but I don't see how it is possible to hedge pairs that move independent of one another. As you see through, correlation often varies quite a bit. 1 Correlation Filter Type in the correlation criteria to find the least and/or most correlated forex currencies in real time. Correlation ranges from % to +%, where % represents currencies moving in opposite directions (negative correlation) and

![Senarai Broker Forex Malaysia Terbaik [ UPDATE TERBARU ] senarai broker forex malaysia](https://nunakoli.space/wp-content/uploads/images/koyq20.jpg)